Decentralized finance—or DeFi—is no longer just a buzzword for crypto enthusiasts. It’s breaking into the mainstream, offering everyday users alternatives to traditional banking, lending, and investing. But how did we get here? And what does it mean for someone who’s never touched a crypto wallet?

Why DeFi Is Going Mainstream

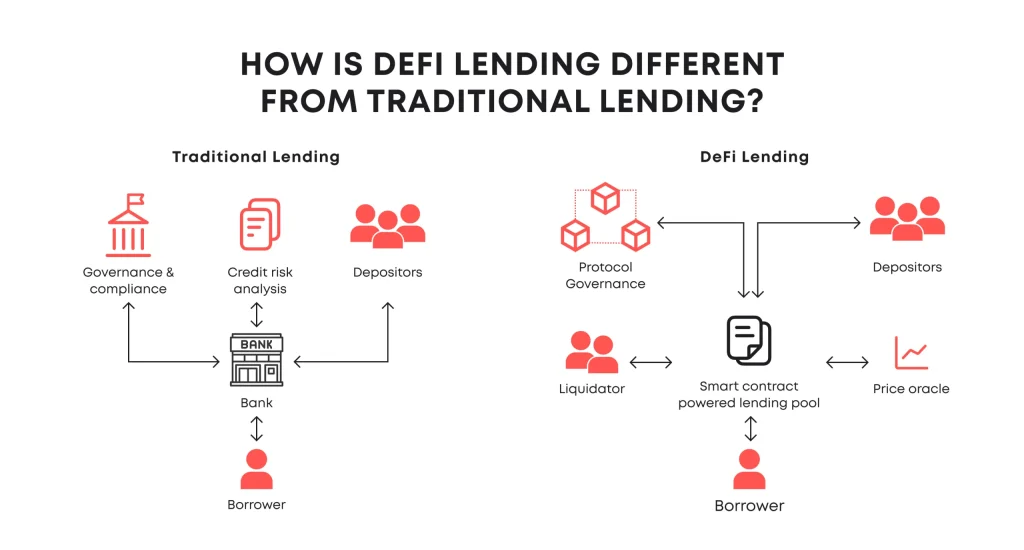

Honestly, it’s a mix of necessity and innovation. Traditional finance? Well, it’s slow, expensive, and—let’s face it—sometimes exclusionary. DeFi flips the script by letting anyone with an internet connection access financial services. No middlemen. No gatekeepers.

Here’s the deal: DeFi runs on blockchain technology, primarily Ethereum. Smart contracts automate everything—loans, trades, even interest-bearing accounts—without a bank in sight. And with rising inflation and economic uncertainty, people are looking for alternatives. DeFi’s transparency and control are hard to ignore.

How DeFi Works for Regular People

You don’t need to be a tech wizard to use DeFi. Here’s a quick breakdown:

- Wallets first: Start with a crypto wallet like MetaMask or Trust Wallet. Think of it as your digital bank account.

- Connect to dApps: Decentralized apps (dApps) are where the magic happens—lending platforms, exchanges, you name it.

- Start small: Swap tokens, earn interest on stablecoins, or dip into liquidity pools. No need to go all-in.

Sure, there’s a learning curve. But compared to setting up a brokerage account? It’s not that different.

DeFi’s Biggest Draws for Mainstream Adoption

1. Higher Yields (Without the Bank)

Banks offer fractions of a percent in interest. DeFi? Some platforms pay 5-10% APY on stablecoins. That’s real money—especially when savings accounts feel like a joke.

2. No Permission Needed

Ever been denied a loan because of your credit score? DeFi doesn’t care. Collateralize crypto, borrow against it. Simple.

3. Global Access

Billions are unbanked. DeFi doesn’t discriminate. If you’ve got internet, you’re in.

The Hurdles—Because Nothing’s Perfect

DeFi isn’t all rainbows. Here’s what keeps some folks hesitant:

- Volatility: Crypto’s wild swings aren’t for the faint-hearted.

- Scams: Rug pulls, phishing—yep, they happen. Research is key.

- Regulation: Governments are still figuring this out. Taxes? Yeah, they apply.

That said, the space is maturing. Insurance protocols, better UX, and clearer rules are coming.

What’s Next? DeFi’s Mainstream Future

We’re at a tipping point. Institutions are dipping toes in. Payment apps are integrating crypto. Even grandma might soon be earning yield on her savings via DeFi—okay, maybe not yet, but you get the idea.

The real shift? When DeFi stops feeling like “crypto stuff” and just becomes… finance.